What is land revenue?

Other Important Facts-

- Introduction of life of Mughal emperor Akbar

- What was the noorjahan faction

- 16 What were Mahajanapadas

Sources of the Mughal Geo Revenue System have been divided into two parts.

- Central income sources and

- Local sources

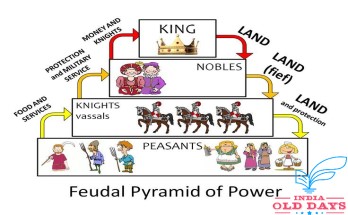

The Mughal land was divided into three parts to systematically manage the distribution of the land-

- Khalsa land was a royal land and the income earned from this land was directly deposited in the royal treasury.

- Jagir land were given to the principal chiefs or persons of the state in the form of their wages, on which they had the right to recover the taxes, but there was no administrative authority.

- Saurgl or madad-e-mash land was given to scholars and religious persons in the form of a grant. On which grant was the hereditary right of the recipient. Though this land was mostly unproductive.

Initially, Akbar adopted the Jabti system adopted by Sher Shah, in which ground production was taken as a part of 1/3 on the basis of Rye.

But Jabti (Jabti-e-Harsala) was very expensive and faulty of the system, in 1568 AD On the recommendation of Shihabuddin Ahmad, it ended and the nask or Knkut system was started in its place.

The following was the various geological systems prevailing at the time of the Mughals-

-

Jabti-e-Dahasala system –

The system was based on the metering and ground-type tax system – this system was implemented in Bihar, Allahabad, Malwa, Awadh, Agra, Delhi, Lahore and Multan.

After the conquest of Gujarat, Akbar personally paid special attention to land revenue. As a result, he took 1573 AD. After leaving Bengal, Bihar and Gujarat in all North India, the officers of the karori, who were 182.

The main task of Karori – was to collect a Coronal Prices (Rs. 250,000 as 1 Rs. 40 =) in the form of revenue.

In the 24th year (1580 AD) of Akbar, Akbar initiated a new tax system called the Iainah-Dasala (Todarmal settlement), and provided the permanent settlement of the Mughal Diligently system.

The real reason behind this system -Todarmal (Khwajahsh Mansur had also helped) was also called Todormal settlement.

Under this system, payment of tax was to be done in cash form. Although the tax was determined in the Dahasala system on the basis of production and prevailing values of the last ten years, but its 1/10 portion was collected every year, which was called Mala-e-Harsala.

The Dahasala system was not implemented in all the entire states. In those areas where the Jabti system was in vogue only in those areas prevailing.

The Ini Dasla system was a type of raiyyatavadi system because in that the farmers were liable directly for imposing penalty per year.

The Maine Dasla system was implemented by Murshid Quli Khan in southern India during the reign of Shah Jahan.

Under this settlement, both the Khalisha and jagir of the land were taken.

Over time, this system has been further improved, under which every soobe has been fixed in the rate of fertilizer, whose fertility was the same.

-

Galla Bakshi System-

In the Mughal period, the oldest and common prevalent system in other systems of taxation was distribution or gala bakhshi. It was also called Bhawoli.

Under this system the crop was divided between a farmer and state in a certain proportion. There was also the state’s right over 1/3 of the produce.

There were three types of revenue determination in this system-

- Field-sharing- The crop was divided as soon as the crop was ready.

- lank sharing –After the harvest, the bund was binding and divided.

- Zodiac sharing –The amount was divided after the grain was ready.

Partition system Sindh, part of Kabul was prevalent in Kandahar and Kashmir.

-

Nasak system-

Modern historians have argued that there was no specific system of taxation or tax evasion, but there was an accounting system of agriculture tax.

Concept was a modified form of system sharing. It was also called Dana bandee.

It was a sort of contractual arrangement arranged in the nasak or concrete system by estimating the yield and payment of previous years (raw estimates) to the landlords or landowners.

The nasak or kankoot system was prevalent in the areas of Bengal, Gujarat and Kathiawar.

For determining geo-revenue, Akbar classified the land in four parts. which is like this-

- Pollus – which is cultivated every year.

- Fallow – When the sowing was done without the sowing to get the fertility again, it was called the fallow.

- Chachar – which was left unutilized for three to four years.

- Barren – It used to be sown for four to five years or longer.

The kaasht kar was done only on the land used in farming.

The unit of area was considered a bigha.

Akbar used to be called Elahi-Samvat based on the calculation of the Sun, it was also called a cropped society.

In the 31st year (1586-87 AD) of Akbar, Sikandari gaj (39 in or 32 in) instead of elahi gaj (41 Ingul or 33 1/2 inch) in the reign of Akbar for the measurement of land. Whereas Sikandari-gaj was used in the measurement of its earlier land.

But in the time of Shah Jahan the measurement was changed again. He started two new measurements-

- Bigha-e-elahi

- Dera-e-Shah Shahjahani (Bigha-e-Daftary).

According to contemporary historian Sadiq – madad-A-mash land was measured from Bigha-i-Elahi but the land for government records was measured by Deira-e-Shahjahani or Bigha-e-Daftari.

After the Aurangzeb, the use of Bigha-e-Daftri ceased but Bigha-e-Elahi kept on till the end of the Mughal period.

In addition to this, Akbar started the practice of Tabu (Tent Rope) instead of Zarib (Bamboo Stripe on which the Iron Keys were connected). Akbar was the first ruler to use Zarib .

Thus there was neither ten-year system nor the permanent settlement of the Dahasala system. The state also had the right to amend it.

Farming was measured in Knkut practice with rows and ropes, and then revenue was realized by estimating per-bigha yield.

Nask practice was an option of conniving practice in Kashmir, in this tradition in Kashmir, Galla-e-Bakhsh and in Gujarat it was called Nask-e-Jujah or Partial Nask.

Other sources of Mughal land revenue-

Apart from land revenue (Khiraj) in the Mughal period, many religious social and local taxes were used.

Babur and Humayun collected taxes from Hindus and jacayas from Muslims.

After the arrival of Islam in India, the Hindus here started collecting tax called Jizya.

was not commonly taken from Brahmins, Sages, orphans, and women, but it was also used to recover these people from the time of Firuzatlak.

Babur and Humayun in the Mughal rulers also collected

jizya tax from the Hindus. But in 1664 AD Akbar ended the religious tax for the first time.

But Aurangzeb reaped this tax in 1679 due to his religious intolerance policy, but in 1713 AD. In Farrukhsiyar, it ended again.

jizya was determined in three categories which were collected on the basis of income-

- 48 dirham jizya was recovered from those who possessed more than 10 thousand dirhams.

- From the 200 dirham, the person with ten thousand dirham property was recovered 24 dirhams.

- The person with less property than 200 dirham was collected 12 dirhams.

Jizya from Mughal administration concluded finally in the reign of Muhammad Shah in 1720. - In lieu of securing state by the zakat Muslims, their property was recovered at a rate of two and a half percent (40th part of the property).

- But this tax was taken only by the Mughal emperors as imports or customs duty.

- Zakat also had one tax in the taxes that Akbar had in his regime. But despite the political ban, it was taken in some form and consequently Aurangzeb had to refuse to accept this tax.

- The Khums was originally a part of the spoils of war in the war, on which 1/5 of the state had the rights of the soldiers on the part of the state and 4/5.

- In the Mughal period, the name Khums was terminated because the Mughal soldiers used to pay salaries. Thus, the entire property received in war or loot was received by the state.

- The revenue of the state also increased due to the offer (cash) or sight which was received by the subordinate kings and the Mons of the Mughal emperors on time.

1700 AD In Aurangzeb, the cash offer was said to be seen and the gifts given to the emperor by the Shahjad are called Niyaj and the gifts of the rich are known as Nissar. - In the Mughal period, the property of a resident without wealth was deposited in Betulmal (Shahi Treasury) by Rajgamita law.

- Akbar ran the Registry of Marriage Regards There was a charge for it.

- Jahangir had abolished the tax named Tamga during his reign.

Reference : https://www.indiaolddays.com/